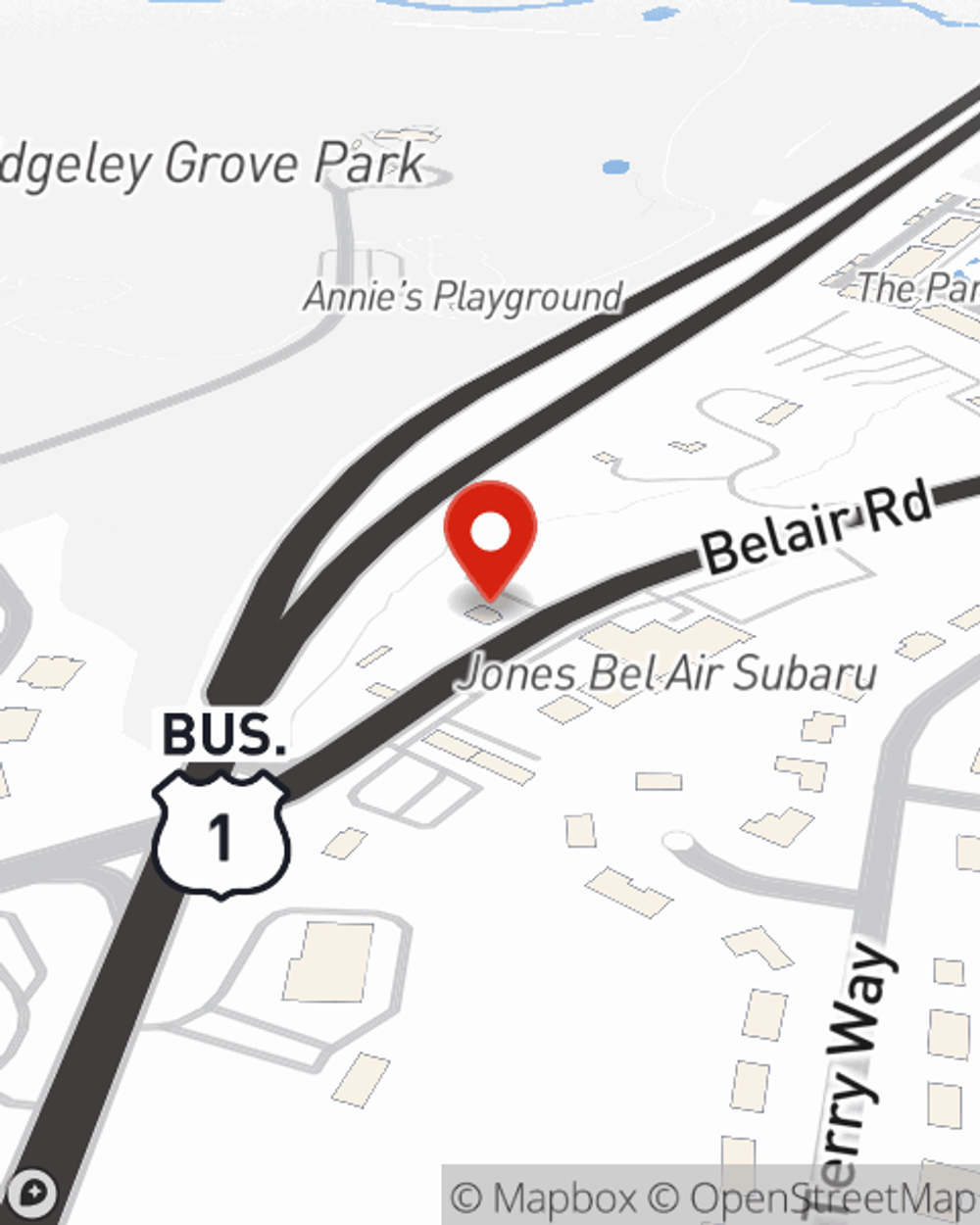

Business Insurance in and around Bel Air

One of the top small business insurance companies in Bel Air, and beyond.

Helping insure small businesses since 1935

- Maryland

- Delaware

- Pennsylvania

- Harford County

- Baltimore County

- Bel Air

- Baltimore

- Kingsville

- Fallston

- Abingdon

- Jarrettsville

- Forest Hill

- Towson

- White Marsh

- Perry Hall

- Middle River

- Essex

- Nottingham

- Rosedale

- Havre De Grace

- Churchville

- Edgewood

Cost Effective Insurance For Your Business.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Matt Gardner help you learn about excellent business insurance.

One of the top small business insurance companies in Bel Air, and beyond.

Helping insure small businesses since 1935

Get Down To Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your pay, but also helps with regular payroll costs. You can also include liability, which is critical coverage protecting your company in the event of a claim or judgment against you by a customer.

Get in touch with the excellent team at agent Matt Gardner's office to find out about the options that may be right for you and your small business.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Matt Gardner

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.